Abstract

An integrated framework that tracks global stocks and flows of natural capital is needed to assess sustainable economic growth. Here, we develop a set of globally comprehensive monetary damages from particulate matter air pollution and greenhouse gas emissions in 165 countries from 1998 to 2018. Our results show that pollution intensity began to rise after a decade during which the global economy became less pollution-intensive from the late 1990s until the Great Recession. Larger economic production shares and higher pollution intensity in China and India drove this change. Deducting pollution damage from output from the late 1990s until the Great Recession yields higher growth estimates. After the Great Recession, this adjustment for pollution damage attenuated growth. We show that modeling monetary damages instead of physical measures of environmental quality affects inferences about sustainable development. Further, the monetary damages from exposure to particulate emissions peak earlier in the development path than damages due to carbon dioxide emissions. Monetary damages peak later than physical measures of both pollutants. For carbon dioxide, per capita emissions maximize at just over 60,000 dollars while monetary damages peak at nearly 80,000 dollars. In 2018, all but two countries were below this income level. Our results suggest that the global economy is likely to exhibit rising damages from particulates and carbon dioxide emissions in the years to come as nations grow and develop.

Similar content being viewed by others

Introduction

The global economy is in transition. Energy systems are moving away from a central reliance on fossil fuels. The COVID-19 pandemic reshaped consumer behavior, labor markets, and business practices. Geopolitics and war disrupted long-standing trade networks. Each of these forces affects energy sources, energy consumption, and, as a consequence, greenhouse gas (GHGs) emissions and local air pollution. As society adjusts to these emergent risks, it does so with an unprecedented emphasis on sustainability. In this transitional state, society must consider what these global-scale disruptions mean for broad-based, sustainable growth moving forward.

When tracking growth and guiding society through periods of upheaval and disruption, policymakers typically rely on the national income and product accounts (NIPAs) which include metrics such as Gross Domestic Product (GDP). In fact, it was nearly a century ago, during the Great Depression, that nations began to formally track their economic progress with the NIPAs1. While the NIPAs have informed generations of policymakers, firms, investors, and households, it is widely known that these tools are incomplete2,3,4,5,6. Critical for the issue of sustainability, the NIPAs capture neither the value of natural resources in-situ nor the costs from pollution emissions5,7. These omissions curtail policymakers’ ability to measure and achieve sustainable growth. Encouragingly, central statistical agencies have begun to expand the scope of the NIPAs; the System of Environmental Economic Accounting8 has been at least partially adopted by 90 countries, now including the United States9. However encouraging, these augmentations typically rely on physical measures rather than monetary accounts. Monetization facilitates three critical aspects of tracking sustainable development. First, it allows for direct inclusion of environmental quality into the NIPAs. Thus, one can deduct environmental costs from the value of market activity to track net growth10,11,12. Second, monetization allows aggregation of values across natural resources, ecosystems, and pollutants into one unified index. Simply tabulating acres, tons, or parts per million of different sources of environmental value inhibits a unified characterization of value. Third, monetization captures changes in society’s willingness-to-pay (WTP) for improvements in environmental quality and health risk reductions. As economies develop, preferences change with respect to the trade-off between income and the environment13. The present paper shows that this effect is the dominant driver in the time period we study in the rise of damages in China and India, two economies that lie at the heart of concerns about global sustainability. Without monetization, these effects would be overlooked.

Conceptually, we adopt the definition of sustainable growth originally proposed in the economics literature decades ago14,15: growth is sustainable if capital formation is non-negative. Critical to this definition is an expansive conceptualization of capital inclusive of both conventional ”man-made” capital as well as ”natural” capital. Thus, as mankind consumes natural resources and relies on the natural environment as a repository for residuals, the value of additional output must exceed the value of lost natural capital.

To apply this framework, this paper tracks two of the key determinants of global sustainable growth: monetary damages from fine particulate matter air pollution (PM2.5) and carbon dioxide (CO2). We assemble a globally comprehensive database on PM2.5 concentrations and CO2 emissions for 165 countries between 1998 and 2018. The empirical analysis then estimates the monetary damage, or the Gross External Damage (GED), by country-year, based on methods outlined in prior literature11,12,16. We build these social cost estimates into the standard NIPAs by deducting the GED from GDP to estimate a more comprehensive measure: environmentally-adjusted value added (EVA)11, that also captures external costs of pollution (e.g., the increase in premature mortality risk from PM2.5 exposure and inter-generational externality from climate change) that are not included in conventional GDP estimates.

While, the paper produces the first set of global, integrated monetary environmental and economic accounts at the country-year resolution over a 21-year panel, we forthrightly recognize that our provisional estimates of EVA are not truly comprehensive. Critical omissions include biodiversity and ecosystem services and water pollution. However, prior research shows that PM2.5 and CO2 cause damages comprising a considerable share of national output in the United States12,17. And, the pollutants that we track are likely positively correlated with pollutants in other media and so are illustrative of the conclusions that would be drawn from a more comprehensive set of environmental accounts, although we acknowledge there will be regional differences in pollution control policies across media.

How do damages from PM2.5 and CO2 relate to natural capital and our conceptualization of sustainable growth? For PM2.5, damages are primarily due to increased mortality risk from exposure18,19. Rising concentrations is a form of natural capital degradation, in this case a loss of clean air. Conversely, falling concentrations embody accumulation of natural capital. Thus, PM2.5 damages reflect a mapping from natural capital (clean air) through exposure to monetary units. For CO2, emissions are valued using the Social Cost of Carbon, or SCC20. This metric reflects the present value of the flow of future damages due to an emission of one ton of CO2. Key sources of damage include diminished agricultural productivity, premature mortality, and sea-level rise21. This latter category includes impacts such as erosion, irreversible inundation, which adversely affects man-made capital and loss of wetlands, and degradation of drinking water resources22. Though the SCC only imperfectly approximates these impact areas, in principle, application of the SCC to monetize emissions of CO2 translates adverse effects on natural capital to monetary units. Thus, our focus on CO2 and PM2.5, while not comprehensive and clearly provisional, is in alignment with a definition of sustainable growth that hinges on rates of natural capital formation and loss.

We make three contributions to the literature. First, we show that the global economy became less pollution damage intensive from the late 1990s until the Great Recession, after which pollution damage intensity (GED/GDP) reversed course and began to rise. After this globally disruptive event, the share of global output contributed by middle-income nations (including India and China) increased markedly. This shift occurred during a period of rapid capital (and pollution) intensification in China and India, overwhelming continued declines in pollution intensity in high income countries. Second, we find that the key factor driving rapidly rising pollution damage in India and China was the increase in WTP for health risk reductions from PM2.5. WTP rises with real income13. Thus, conventionally-defined economic development poses two risks to sustainability: rising pollution emissions from growth and rising monetary damage due to changes in society’s preferences. Third, the paper reports that combined PM2.5 and CO2 damages peak when per-capita income nears $50,000, per year. In 2018, the final year covered in this paper, 145 out of 160 countries were below this income level. Thus, the global economy is likely to exhibit rising damages in the years to come as nations grow and develop. This emphasizes the need for more holistic measures of economic growth.

Results

Figure 1 plots real GDP and EVA growth on the left axis, and EVA minus GDP growth on the right axis, for the global economy between 1998 and 2018. The figure employs our default assumptions in estimating the damages from PM2.5 and CO2 (see Methods). Perhaps the most striking pattern in Fig. 1 is the Great Recession in 2008 and 2009, when global growth dropped from about 4% to −1%. Though the primary effects of this globally disruptive event manifest within the market economy, the Great Recession coincides with a change in the difference between EVA and GDP growth. From 1998 to 2008, EVA outpaced GDP growth (see Fig. 1). The global economy was becoming less pollution damage intensive. (If EVA growth exceeds GDP growth, the GED must grow by less than GDP.) The spread in growth rates was largest at the end of the 20th century (about 0.4%) and it gradually attenuated to about zero in 2008. For context, in 2000, global GDP was about $50 trillion. So a difference of 0.4% growth amounts to approximately $200 billion. After the Great Recession, by the end of the 2010s, GDP growth exceeded EVA. The global economy was becoming more pollution damage intensive. Thus, the Great Recession coincided with the reversal in a decade-long trend of the global economy becoming less pollution damage intensive. These shifts are also reflected in Fig. S1 in our Supplementary Information (SI), where we map the difference in GED/GDP for each country across the decade prior to the Great Recession and then after.

Why did the global economy become more pollution damage intensive after the Great Recession? First, the share of global output contributed by developing economies steadily increased from roughly 23% in 1998 to 36% in 2018. This change was driven by rising exports from developing countries to developed nations as well as rapid growth in trade among developing nations23. In upper middle income economies, which includes China, the share of global output increased by 17% subsequent to the Great Recession. The low middle income economies experienced a 37% increase in their share of global output during after the Great Recession. India’s rapid economic growth was a major driver of this increase, along with other fast growing Asian economies such as Bangladesh and Vietnam. The share of global output amongst the low income nations grew by 27% during the post Great Recession period. However, the absolute contribution to global production remained small.

Second, changes in output shares occurred in parallel with changes in pollution intensity of output, shown by the major income groups in Fig. 2. Note that countries are grouped according to their income status in 2018—graphing according to current year income status produced odd results when countries such as China moved from the lower middle income to the higher middle income group. A central determinant of pollution intensity across these income groups were the relative shares of GDP comprised by investment (capital formation) and final consumption. Among the upper middle income group, pollution intensity surged from just over 7% to 10% by 2018 (Fig. 2). Concomitantly, the investment share of GDP grew from under 25% in 1998 to 35% by 201824. In China, pollution damage intensity also grew from 7% to 10% and investment increased from just over 30% of GDP in 1998 to 45% in 201324: this while real GDP per capita appreciated by over 8% annually from 2000 to 2010. The consumption share of GDP fell from over 60% in 1998 to 50% in 201024. In SI Figure S2 without China, the upper-middle income group exhibited flat pollution damage intensity of about 6–7% between 1998 and 2018. The comparison of Fig. 2 and S2 highlights the role that China played in driving aggregate pollution intensity in this income group. Further, this comparison emphasizes China’s part in reversing the global trend of declining pollution intensity from the late 1990s to the Great Recession.

In low-middle-income nations, pollution damage intensity increased gradually from 7% of GDP in 1998 to about 8% in 2018 (Fig. 2). Capital intensity also increased gradually, from 25% in 1998 to just under 30% in 2009 before leveling off thereafter24. In India, like China, capital intensification induced pollution intensification. From 1998 to 2007, GED amounted to about 5% of GDP in India. Over the next decade, GED grew to 7% of output. Investment grew from 25% of GDP in 1998 to over 35% in 200724. Over the same period, the consumption share dropped from 75% to 65%24. However, India was not the only contributor to the pollution intensification of lower middle-income economies. In Bangladesh for example, pollution intensity rose from 4% to 7% during the sample period, while in Vietnam, pollution as a share of output doubled from 5% to 10%. Increases in pollution intensity for these two countries were at least driven in part by the shift in low-end manufacturing such as textiles and apparel out of China as labor costs increased and firms relocated production23. In Bangladesh, higher levels of economic activity including in sectors such as construction and transportation also contributed to this increase25.

The top-left panel of Fig. 2 shows that pollution damage intensity in the high income countries fell from 10% of GDP in 1998 to 7% in 2018. Accordingly, between 1998 and the Great Recession, the investment share of GDP fell from 24% to under 21%24. After the Great Recession, the capital share stabilized and grew slightly until 201824. The consumption share of GDP increased24. High-income countries exhibited growth of about 2% from 1998 to 2008, near zero from 2008 to 2011, and 1% thereafter (see Supplmentary Fig. S3)26. During the low GDP growth period, pollution intensity flattened as capital formation stabilized (Fig. 2). Coupled with rising output shares and pollution intensity among the middle income economies, the attenuation of the downward trend in pollution intensity amongst the high income countries explains the reversal of the decades-long trend of globally declining pollution intensity.

Among the four income groups in Fig. 2, low-income economies show the lowest and most stable pollution intensity of output. GED remained at roughly 4% of GDP from 1998 to 2018. Capital formation held between 20% and 25% of GDP from 1998 to 201224. However, the share of global output amongst these nations grew by 27% during the post Great Recession period. This increase occurred in parallel with a rising investment share of GDP (to just over 30% in 2017)24. In the case of low-income nations, this recent surge of capital formation did not translate into rising pollution intensity. We note that the potential onset of rapid economic growth in these nations, for instance as replacements of Asian manufacturing hubs in global trade27,28, may lead to increased pollution intensity in the future.

A review of the results in Fig. 2 provides a useful perspective on how the pollution intensity of output changed over the development trajectory of the world’s economies. In 1998, pollution damage intensity increased with income levels; from 4% to 7% to 10% up the income scale. However, by 2018, pollution intensity was lower in the high-income group than both the upper-middle and low-middle-income countries. This reordering of pollution intensity relative to income reflected massive capital investment in middle-income economies (particularly China and India) and a greater consumption share of GDP in high-income countries. The result of these structural changes to the world’s largest economies was that in 2018, pollution intensity increased with income, up to a point, and then fell at the highest income levels. The emergent, non-monotonic, or inverted “U-shaped” relationship between damage intensity and income is suggestive of an Environmental Kuznets Curve (EKC). We discuss this in more detail below.

Gross external damages from PM2.5 and CO2

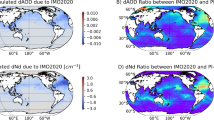

Next, we separately analyze the GED due to PM2.5 and CO2 for the eight largest economies by GDP. Figure 3 plots indexed values of the total GED, as well as that for PM2.5, and CO2.

In the western economies, GED from PM2.5 fell between 1998 and 2018, while the CO2 GED increased. In these nations, regulation limiting emissions of air pollution has been in place for decades. Thus, policy is likely to have been one factor contributing to the notable decline in air pollution damage. In the European economies, controls on CO2 emissions have also been in place for most of the 21st century. This is not the case for the U.S. The differential regulatory context for CO2 among western economies was likely a factor driving difference in GED growth; real GED from CO2 increased by nearly 50% in the U.S. and by a much smaller degree in the European countries, as shown in Fig. 3. Prior authors29 have also noted the divergence between GDP growth and CO2 emissions in the European countries, a pattern especially prominent in the post 1990 period. Our goal in noting the presence of regulatory systems in the US and the EU is to contrast pollution intensity trends in “regulated” nations against trends in nations without such constraints. We leave the exercise of estimating the precise contribution of particular policies and regulations to the trends observed in Fig. 3 to future work.

China exhibits a strikingly different pattern. From 1998 to 2007, GED from PM2.5, and CO2 increased at similarly rapid rates. Then, beginning around the time of the Great Recession, PM2.5 damages broke the trend and began to rise more slowly. In China, efforts to limit air pollution began around the time of the Olympics in 2008, and further efforts, including the so-called war on pollution, commenced in 201430,31. CO2 damages, in contrast, continued rising rapidly. The GED (both PM2.5 and CO2) in India increased exponentially without a clear break in trend. The primary policy initiative to curtail air pollution was not announced until 201932. Without meaningful regulatory constraints, pollution damages increased rapidly as the Indian economy experienced rapid GDP growth. Ambient PM2.5 concentrations and CO2 emissions across these eight major economies are shown in SI Figs. S4 and S5.

The results in Fig. 3 suggest three stages in the relationship between economic development, environmental policy, and pollution intensity. Developed western economies have entrenched regulatory systems. The result is GDP growth outpacing changes in the GED and decreasing pollution intensity. China represents a nation at a middle stage. In the late 1990s and early 21st century, China grew rapidly, fueled by capital formation rates that surpassed GDP growth, without constraints on emissions. Then, with the implementation of pollution controls, the exponential increase in the GED was broken. Future pollution damage intensity in the Chinese economy will continue to depend on rates of capital formation, and changes to the stringency and scope of existing policies. India represents a third case: a rapidly growing economy, with capital formation growing as a share of GDP, without policy constraints on emissions (during the period covered in this analysis). As such, the GED grew exponentially. How pollution intensity evolves in the Indian economy will depend on capital intensity, and the stringency and enforcement of its newly enacted policies.

Environmental Kuznets curve

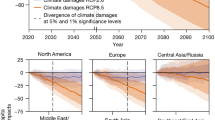

Figure 4 plots EKCs for PM2.5 and CO2 using every country-year pair of data (functional form and all model specifications for the EKC are provided in SI Section 6). For each pollutant, we plot monetary damages and a physical measure (tons and μg/m3) against income on a per capita basis. Prior articulations of the EKC plot physical measures of environmental degradation (tons of pollution emitted) against income33,34,35. This literature and the mechanics of the EKC have been extensively reviewed in36. Our emphasis here is on how tracking pollution in terms of monetary damage influences the EKC. As mentioned above, monetization recognizes that not all tons or μg/m3 of pollution are equally harmful—even those of the same pollutant. For example, the marginal damage of CO2 emissions increases as the extant stock of ambient CO2 grows. Thus, as the atmospheric stock accumulates through time, the damage per ton also grows. Prior literature has shown that as a result of this accumulation of CO2, the SCC has risen nearly six times between 1950 and 201837. Similarly, as the population grows or the WTP to avoid exposure risk grows, the damage from each μg/m3 of PM2.5 changes. In a dynamic EKC framework, as economies grow and develop, simply tracking physical units neglects these changes in damage.

Panel (a) of Fig. 4 displays quadratic fits for PM2.5. The implications of tracking damage versus physical units are especially stark in this case. Concentrations maximize at very low levels of income such that the EKC falls over the relevant range of income. In contrast, the GED for PM2.5 maximizes at about $45,000. These two EKC fits yield very different conclusions about sustainable growth. When plotted in terms of physical concentrations, merely growing beyond subsistence levels of income is sufficient to begin drawing down PM2.5 levels. However, damages (which are partially driven by real income growth) continue to rise as society’s WTP to avoid health risks from PM2.5 at the margin, or the value of statistical life (VSL)13, also increase. While many countries have enjoyed falling PM2.5 concentrations, relatively few experienced falling damages. According to the income data compiled in this paper, countries at or above $45,000 include those in Western Europe and the U.S., Australia, Canada, Japan, Qatar, UAE, and Singapore.

Panel (b) of Fig. 4 focuses on CO2. Per capita tonnage maximizes at just over $60,000. Monetary damages reach their peak at nearly $80,000. By the end of our analysis period, in 2018, just two countries reached this income level (Luxembourg and Norway). In this case, the SCC rises (uniformly for all countries since GHGs are globally mixed) through time as the stock of CO2 accumulates. This stands in contrast to the intertemporal changes in PM2.5 damages which are driven by concentrations, population, and income. Note that the relatively fewer observations at higher income levels mean that the standard errors for those estimates are high. However, we observe time series decreases in annual emissions of CO2 in high-income countries; in the U.S. CO2 emissions peaked during the Great Recession. The comparison between physical measures and monetary damages for PM2.5 and CO2 yields the same inference: damages maximize at higher real income levels than emissions.

Figure S6 in the SI plots the EKC for combined PM2.5 and CO2 damages. Globally, damages peak at just under $3000 at an income level just under $50,000 in our base case. Very few countries in the database used in this analysis have reached this income level. Note that it is infeasible to combine the physical measures of each pollutant because they are measured in different units. Further, even if PM2.5 was expressed in tonnage, the impact caused by each ton is vastly different than CO2. Finally, Figure S7 in the SI plots the EKC curve by region.

The upshot of our analysis of the EKC is that globally, very few countries have hit peak per capita pollution damage. Those that have are among the highest-income nations. Thus, the EKC analysis supports our findings in Figs. 2 and 3. Some of the world’s largest, fastest-growing economies are likely to exhibit rising pollution damage in the years to come. The fact that CO2 damage maximizes at higher per capita income levels than PM2.5 also bears a connection to environmental policy. Many Western economies began limiting air pollution decades ago, when per capita incomes were lower. Far fewer economies have binding limits on CO2 emissions. Those that do enacted such policies relatively recently, when per capita income was relatively high. That PM2.5 damages peak earlier in the development path is a direct result of these systematic differences in the timing of policies targeting local air pollution and GHGs.

Sensitivity analysis

Our sensitivity analysis consists of two parts. First, we explore the roles that ambient concentrations and income growth play in determining PM2.5 damages. Second, we undertake a parametric sensitivity analysis, varying the VSL and SCC and documenting corresponding changes in the GED and EVA.

Drivers of PM2.5 damages and gross external damages

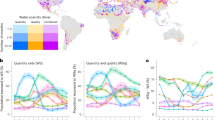

Figure 5 uses decomposition analysis to show the role of income and concentrations in the PM2.5 damages estimates for the eight largest economies by GDP. In each plot, the red line allows both concentrations and income to affect the GED. The blue line holds concentrations fixed and allows income (and therefore the VSL) to change. The green line holds income fixed and allows ambient concentrations to change. In China and India, the effects of rising pollution levels and rising incomes on damage are mutually reinforcing. Hence, the red lines lie above both the blue and green lines. In these economies, growth in income is largely responsible for the growth in damages. In China’s case, the fivefold rise in real income during the period of our analysis translated into a proportional increase in the VSL (see Supplementary Fig. S8 in the SI for the estimated VSL in the eight largest economies). Though PM2.5 levels climbed until the war on pollution (by about 50%, see Supplementary Fig. S4), this increase was dwarfed by the change in income. As such, and as shown in Fig. 5, the rising real WTP for health risk reductions (the VSL) dominated the total increase in PM2.5 damages in China. Rising ambient concentrations played a relatively minor role.

The red line in the plot is PM2.5 damages that account for both changes in population-weighted PM2.5 concentration and changes in VSL through changes in income. The blue line is the estimate for PM2.5 damages if we keep PM2.5 concentration fixed at 1998 levels but allow income and therefore the VSL to change over time. Conversely, the green line is the estimate for PM2.5 damages if we keep income and therefore the VSL fixed at 1998 levels but allows PM2.5 concentration to change over time. Note the different scale for China and India.

Like the case of China, in India, the income effect is the dominant driver in pollution damage growth. Between 1998 and 2018, real income tripled, whereas average PM2.5 concentrations increased by less than a factor of two. In fact, until 2005, all growth in PM2.5 damage in India was a function of growth in income. Eventually, post 2005, the development of the Indian economy resulted in physical pollution levels growing markedly worse (also see Supplementary Fig. S4). Summarizing, the globally important cases of China and India make clear the two channels through which economic development affects pollution damage. First, economic activity results in more emissions and higher concentrations. In parallel, as incomes rise, the VSL rises (see Figure S8). Figure 5 makes clear that for two of the world’s largest and most rapidly developing economies, it is the latter income effect that is the central driver of pollution damage. Crucially, measures of sustainability that focus on physical emissions or concentrations miss this effect.

For developed countries, especially western Europe and the U.S., we see a different pattern. Pollution levels and income change in opposing directions. While in China and India these effects are mutually reinforcing, in developed countries the rising VSL partially offsets improving air quality. As discussed above, in the developed economies, ambient PM2.5 fell since 1998 (also see Supplementary Fig. S4). Yet, real income growth has been largely positive, despite a dip during the Great Recession. Because the rate of decline in pollution was greater than the increase in real income, the net result of these two effects was falling PM2.5 GED, as is evident in Fig. 5.

The implications of these results for total GED depends on the relative share of PM2.5 and CO2 damages in GED. Supplementary Fig. S9 in the SI shows the share of PM2.5 in GED across the different income groups. PM2.5 damages comprise a larger share of total damages in high income countries (80% to 90%) than the other income groups (between 60% and 80%). This is because of the much higher income (and VSL) levels in the high income group. Importantly, PM2.5 damages are the majority share of GED across all income groups and therefore drive the estimates of EVA. Whether this remains the case in the future will critically depend on the stringency and enforcement of air pollution policies in China and India, as well as the development paths for the low income countries.

Parametric sensitivity analysis

Though by no means comprehensive, our parametric sensitivity analysis covers the key parameters in our GED and EVA calculations: the VSL and the SCC. We begin with an alternative VSL. In the default case, the VSL for the U.S. is $7.4 million. In the sensitivity analysis, we employ a VSL of $2.8 million based on a review of contingent valuation studies38. The procedures used to extrapolate this value to countries other than the U.S. are identical to that employed in the default case (see Methods). Thus, the relative VSL across countries (and within each country across time) does not change. As one would expect, Supplementary Fig. S10 indicates that the lower VSL results in lower levels of pollution intensity across all income groups.

In the next permutation to our assumptions, we alter how the VSL changes with real income growth. In the default case, the sensitivity of the VSL to changes in real income varies with the level of income39,40. In the sensitivity analysis, we assume that a 1% increase in real income causes a 1% change in the VSL irrespective of the income level. Supplementary Fig. S10 demonstrates that the marginal damages for PM2.5 rise more rapidly with this assumption. The upshot of this is that the high-income economies exhibit slower declines in pollution intensity compared to the default case.

An alternative approach, potentially addressing equity considerations, would be to employ the VSL as estimated for the U.S. to all countries. According to this assumption, mortality risk is valued equally, irrespective of income levels. Though we do not report the results here, we note that under this assumption, several countries exhibit negative adjusted output; that is, the GED exceed GDP. Given that the VSL is a WTP-based measure, and that WTP is a function of ability-to-pay, we contend that applying a high-income VSL (such as that for the U.S.) uniformly to all countries is not appropriate. Further discussion of VSL-income elasticities is in Methods.

In our final sensitivity analysis, we use a higher estimate of the social cost of carbon from a recent study which incorporates improved probabilistic socioeconomic projections, climate models, damage functions, and discounting methods and is valued at $185/tCO2 in 2020 dollars21. As Supplementary Fig. S10 demonstrates, this leads to much higher estimates of pollution intensity across the income groups.

Conclusion

This paper argues for an augmented set of national income and product accounts as a means to track and assess sustainable economic growth. In doing so, we adopt the definition of sustainable growth proposed in economics decades ago14,15. Sustainable growth requires non-negative capital formation, inclusive of both conventionally conceived man-made capital as well as natural capital. Thus, as mankind uses natural resources and the assimilative capacity of the natural environment to produce goods and services, the value of additions to output must exceed the loss of natural capital.

We demonstrate this approach by calculating monetary damages from CO2 and PM2.5, two crucial forms of natural capital degradation, in 165 countries from 1998 to 2018. The empirical analysis delivers three key findings, each of which hinges on our focus on monetary damages from pollution, rather than simply tracking tonnage or ambient concentrations. First, globally, pollution damage intensity fell appreciably from the late 1990s until the Great Recession. Thereafter, pollution intensity stabilized and then began to increase toward the end of the 2010s. This global shift was due to an increased share of global GDP coming from more pollution damage intensive developing economies. Had we simply tracked global CO2 intensity in tonnage/GDP, we would have shown pollution intensity falling by 20% over the same period. Our inclusion of both air pollution and CO2 is central to our findings, as PM2.5 damages increased rapidly in both China and India. Tracking multiple pollutants in a combined damage index is only possible through monetization, since tons of CO2 and PM2.5 impose very different costs on society.

Second, we then decompose the global results by major income groups. High-income countries have been on a cleaning-up trajectory since the late 1990s, with reductions in PM2.5 damages overwhelming modest increases in CO2 damage. The upper-middle income group exhibited a sharp rise in pollution damage intensity, driven almost entirely by the Chinese economy. Lower middle income countries including India are now charting the same path as the upper middle-income nations. The trends in pollution intensity appear to be fundamentally driven by the investment and consumption shares of GDP. Economies in a phase of man-made capital intensification exhibit pollution intensification. Nations with high shares of consumption show declining pollution intensity. Relatedly, the globally important cases of China and India make clear two channels through which economic development affects pollution damage. First, economic activity (especially man-made capital intensification) results in more emissions and higher concentrations. And, as incomes increase, the VSL rises. We find that for China and India, it is the latter income effect that is the central driver of pollution damage. Measures of sustainability that focus on physical emissions or concentrations miss this effect.

Lastly, our EKC plots monetary damages against income on a per capita basis, whereas earlier versions of the EKC plot physical measures of environmental degradation (tons of pollution emitted) against income33,34,35. For both PM2.5 and CO2 we find that physical measures of pollution reach their peak at lower income levels than monetary damage. A central conclusion from our EKC analysis is that globally, very few countries have hit peak per capita pollution damage. Those that have are among the highest-income nations. This means that China and India are likely to exhibit rising pollution damage in the years to come. A second result of the EKC analysis is the fact that CO2 damage maximizes at higher per capita income levels than PM2.5. We conclude that this occurs because many developed economies began limiting air pollution decades ago, when per capita incomes were lower. Far fewer economies have binding limits on CO2 emissions. Those that do implemented such policies relatively recently, at higher per capita income levels. That PM2.5 damages peak earlier along the development path stems from systematic differences in the timing of policies targeting local air pollution and GHGs.

In concluding, we note two especially important caveats to our work. First, while we focus on two globally important pollutants, our provisional augmented accounts are not comprehensive. Potentially major omissions include water pollution, ecosystem services, and the value of natural resources in situ. As argued above, degradation of water resources as well as terrestrial natural resources are likely to be positively correlated with emissions of the pollutants we track. This implies alignment between the trends in global pollution damage intensity we report and those resulting from a more complete set of accounts. In terms of excluded air emissions, non CO2 GHGs such as methane (CH4) are omitted from our country-level analysis as data sources for methane emissions are not as easily available as CO2. In our SI (Section 10) we tabulate global methane emissions (2000-2017) and estimate its impact on global GED and differences in growth rates. We find that the trends shown in Fig. 1 do not change, and methane remains a small (<10%) albeit increasing part of global GED. For impacts on ecosystems and vulnerable species with intrinsic value, monetary damages would not be influenced by income levels and therefore physical environmental variables may present a better assessment. Second, we truncate our analysis in 2018 because of limits to data availability. Country, cause, and year-specific mortality rates are not available for the full panel of countries past 2019. Reliance on pre-COVID mortality rates would introduce considerable (and potentially problematic) uncertainty into estimates of deaths attributable to PM2.5. To explore the years 2019 through 2021, we gather data on global CO2 emissions and we compute CO2 damages to 2021. In terms of tonnage, CO2 intensity continued to fall through 2021. However, damage intensity increased considerably in 2021 as the global economy began to emerge from the COVID-19 pandemic. Thus, the divergence between inferences about sustainability drawn from physical and monetary measures appears to endure. Though these qualifications to our work are critical to emphasize, the findings in the present paper argue strongly for future research targeting additional extensions to the NIPAs in an effort to holistically measure sustainable growth.

Methods

This section describes data sources and computational methods for CO2 and PM2.5 damages. It concludes with a discussion of the integration of damages into the NIPAs.

Damages from CO2 emissions

CO2 emissions are obtained from the Emissions Database for Global Atmospheric Research41. To compute monetary damages from CO2 emissions we use the SCC, which is the marginal damage per ton of CO2 emitted. SCC estimates vary widely in the literature. We use estimates from the US Government’s IWG study20 which provides estimates of the global SCC for 2010-2050 every five years. We compute the SCC for relevant years in our dataset by deriving the annual growth rate. We use a central estimate of $36 (2007 dollars) in 2015 which corresponds to the 3% discount rate. We also perform sensitivity analysis for a high damage scenario for the SCC based on recent revised estimates21.

Note that the SCC only varies temporally and not spatially to reflect the fact that CO2 is a globally mixed pollutant with global impacts. This is justified on the basis that GDP tracks the value of economic activity according to where production occurs. So, for e.g., goods that are produced in the U.S. and then traded to another country for final use are attributed to U.S. GDP. Our approach to tracking the monetary value of pollution emissions is conceptually consistent with GDP, and it adheres to the suggested approach in NAS NRC (1999) and Nordhaus4. Both sources suggest calculating damage as the product of marginal damage and total emissions, and attributing the damage to where the emissions are released. CO2 causes damages globally by increasing the stock of atmospheric carbon. Note that the same thing is true, in theory, for PM2.5. We acknowledge that our approach to valuing PM2.5 departs from this by valuing local concentrations and health impacts. But this is necessitated by a lack of global emission mixing data for PM2.5, and that the conceptual error that this introduces is likely to be small simply because PM2.5 is a regional pollutant: damages tend to occur proximate to the emission source. Finally, while the empirical methods to estimate location-specific damages for air pollutants such as PM2.5 have been used for decades18, country-specific decompositions of the SCC are recent and the considerable uncertainties associated with this approach have yet been fully explored. Doing so lies beyond the scope of this paper.

We also highlight that accounting for local versus global damages from climate change in calibrating the SCC has also been under scrutiny in U.S. climate policy following the Trump administration’s decision to lower the SCC by only valuing damages from climate change accruing within U.S. borders. This was subsequently reversed by the Biden Administration on the grounds that “a global perspective is essential for SC-GHG estimates because climate impacts occurring outside U.S. borders can directly and indirectly affect the welfare of U.S. citizens and residents”42. Other countries including Canada and Germany also use estimates of the global damage from one additional ton of CO2 in their regulatory analyses and not a country-specific estimate43,44. A National Academies report on the SCC also noted that “climate damages to the United States cannot be accurately characterized without accounting for consequences outside U.S. borders”45. Recent scientific guidance on the subject has also been consistent with advocating for using a global SCC in analyses46,47,48. Finally, previous national environmental accounting exercises have also been computed using global SCC estimates16,17.

Damages from CO2, denoted (Di,tC), for country i in year t, are the product of marginal damages and emissions:

Damages from local air pollution

Although exposure to air pollution is associated with a number of adverse health and productivity impacts, this analysis computes the monetary damage from mortality risk associated with PM2.5 exposure. Prior research shows that this health endpoint comprises the majority of pollution damage16,18,19. Further, valuation of morbidity states and illness often employs cost-of-illness estimates18,19, which are largely captured as household expenditures in metrics such as GDP. Since our goal is to augmented the market accounts with costs not already incorporated, and because morbidity effects have been shown to be relatively small, we focus on premature mortality risk. The key data sources for these calculations of damages from PM2.5 exposure include the following. Population-weighted annual average PM2.5 concentration, by country and year, are obtained from refs. 49,50. In addition to the PM2.5 concentrations, we employ global data for baseline mortality risk and population51.

The calculation of damage from PM2.5 begins with the estimation of the relative risk from PM2.5 exposure. The relative risk is a function of the PM2.5 concentration and it is calculated through the integrated exposure response (IER) function, which is widely used in international assessments of mortality risk from PM2.5 exposure52,53.

where αj,k, βj,k, and γj,k are statistically-estimated parameters (note that the age group-specific IER only applies to stroke and ischemic heart disease52,53), PMi,t is the level of PM2.5 concentration for country (i) in year (t), and PMcf the theoretical minimum risk exposure level below which no risk is assumed. The subscript (j) denotes the cause of death, which includes stroke, lower respiratory infections, diabetes, chronic obstructive pulmonary disease, ischemic heart disease, and lung cancer. The subscript (k) indicates age group. The IER function was fitted by estimating the parameters αj,k, βj,k, γj,k, and PMcf using the methodology described in52. The pollution-attributable fraction (PAF) is the risk contributed by PM2.5 exposure:

Attributable excess mortality from exposure is estimated by evaluating (2) and (3) using the country and year-specific ambient PM2.5 data, and then computing the product of (3) and age group (k) and cause (j) specific baseline mortality rates (Λ) along with the relevant population age groups for each end point. Excess mortality ΔM attributable to PM2.5 for country (i) in year (t) is then:

Calculating monetary damage requires the application of the VSL to the estimated PM2.5-attributable excess mortality.

where VSLi,t is the value of statistical life for country (i) in time (t). For the U.S., we employ the U.S.EPA’s VSL of $7.4 million ($2006) and run a sensitivity for a VSL of $2.8 million ($2000)38. We lack government-endorsed VSLs for applications in most countries aside from the U.S. We estimate VSLs for countries other than the U.S. based on VSL-income elasticities from the literature26,39,40. Country-by-year income data from 1998 to 2018 are obtained from the World Bank26,54. The particular income elasticities employed depend on country income levels40,55 and ref. 56 have argued that higher elasticities are more appropriate for lower-income countries. Estimates from stated preference studies also suggest that the VSL-income elasticity is higher in lower income countries. Masterman et al.57 for instance, find an income elasticity of 0.55–0.85 for higher-income countries and 1.0 for lower-income nations. Narain et al.39 suggest an elasticity of 0.8 for high income economies and 1.2 for low and middle-income countries. These elasticities were subsequently used in58. We follow this latter parameterization of the VSL-income elasticity. One justification for adopting this approach is that it was endorsed by the World Bank. If countries around the world produced integrated environmental and economic accounts, they would likely do so in accordance with international standards which might include this guidance from the World Bank. In a sensitivity analysis, we set the VSL-income elasticity to unity for all countries.

Within a country, the VSL is held fixed cross-sectionally as is standard practice18,59.

The VSL for country i in 2006 is:

and then we estimate the VSL in year (t) using the approach in (7):

where η is the VSL-income elasticity.

Note that we ignore lower productivity effects arising from premature mortality due to data constraints. These are also likely to be relatively small60.

Gross external damages

Having estimated air pollution and CO2 damages, we integrate these values into the national income and product accounts. We calculate EVA as GDP less damages11,12. The World Bank provides annual, real GDP for each country54 (note that VSL values in USD 2006 and SCC values in USD 2007 are converted to USD 2010 prices using inflators from the Consumer Price Index).

The conceptual justification for this treatment of damages is provided in refs. 3,4.

Data availability

Our analysis synthesizes many already available data sources as detailed above in Methods. All input data files as well as computed results for all 165 countries across different metrics (EVA, GED, CO2 damages, PM2.5 damages, and others) are publicly available at https://doi.org/10.5281/zenodo.7903337.

Code availability

The code for producing all results and figures in the paper is available on Github at https://github.com/ani-mohan/Measuring-monetary-damages-air-emissions.

References

U.S. Department of Commerce. Concepts and Methods of the U.S. National Income and Product Accounts (2022).

Dasgupta, P. Human Well-Being and the Natural Environment (OUP Oxford, 2001).

Abraham, K. G. & Mackie, C. A framework for nonmarket accounting. In A New Architecture for the US National Accounts, 161–192 (University of Chicago Press, 2006).

Nordhaus, W. D. Principles of national accounting for nonmarket accounts. In A New Architecture for the US National Accounts, 143–160 (University of Chicago Press, 2006).

Dasgupta, P. Nature in economics. Environ. Resour. Econ. 39, 1–7 (2008).

Mazzucato, M.The value of everything: Making and Taking in the Global Economy (Hachette UK, 2018).

Nordhaus, W. D. & Tobin, J. Is growth obsolete? In Economic Research: Retrospect and Prospect (National Bureau of Economic Research, 1972).

United Nations. System of environmental-economic accounting. https://seea.un.org/.

White House Office of Science and Technology Policy. National strategy to develop statistics for environmental-economic decisions. https://www.whitehouse.gov/wp-content/uploads/2023/01/Natural-Capital-Accounting-Strategy-final.pdf.

Bartelmus, P. The cost of natural capital consumption: accounting for a sustainable world economy. Ecol. Econ. 68, 1850–1857 (2009).

Muller, N. Z. Boosting GDP growth by accounting for the environment. Science 345, 873–874 (2014).

Muller, N. Long-run environmental accounting in the U.S. economy. In Environmental and Energy Policy and the Economy, vol. 1, 158–191 (University of Chicago Press, 2020).

Viscusi, W. K. & Masterman, C. J. Income elasticities and global values of a statistical life. J. Benefit-Cost. Anal. 8, 226–250 (2017).

Solow, R. M. Intergenerational equity and exhaustible resources. Rev. Econ. Stud. 41, 29 – 45 (1974).

Hamilton, K. Green Adjustments to GDP. Resour. Policy 20, 155–168 (1994).

Muller, N. Z., Mendelsohn, R. & Nordhaus, W. Environmental accounting for pollution in the United States economy. Am. Econ. Rev. 101, 1649–75 (2011).

Tschofen, P., Azevedo, I. L. & Muller, N. Z. Fine particulate matter damages and value added in the us economy. Proc. Natl Acad. Sci. 116, 19857–19862 (2019).

U.S. Environmental Protection Agency. The benefits and costs of the Clean Air Act 1990 to 2010. In Report, EPA-410-R-99-001, Final Report to US Congress (U.S. Environmental Protection Agency, 1999).

U.S. Environmental Protection Agency. The benefits and costs of the Clean Air Act from 1990 to 2020 (U.S. Environmental Protection Agency, 2011).

IWG. Technical support document: Technical update of the social cost of carbon for regulatory impact analysis-under executive order 12866-interagency working group on social cost of carbon. United States Government (White House, 2013).

Rennert, K. et al. Comprehensive evidence implies a higher social cost of co2. Nature 610, 687–692 (2022).

Diaz, D. B. Estimating global damages from sea level rise with the coastal impact and adaptation model (ciam). Clim. Change 137, 143–156 (2016).

Meng, J. et al. The rise of south–south trade and its effect on global CO2 emissions. Nat. Commun. 9, 1–7 (2018).

World Bank. World Development Indicators. https://databank.worldbank.org/source/world-development-indicators.

Hassan, M. S., Bhuiyan, M. A. H. & Rahman, M. T. Sources, pattern, and possible health impacts of pm2. 5 in the central region of Bangladesh using pmf, som, and machine learning techniques. Case Stud. Chem. Environ. Eng. 8, 100366 (2023).

World Bank. World bank country and lending groups. https://datahelpdesk.worldbank.org/knowledgebase/articles/906519 (2019).

Guan, D. et al. Structural decline in China’s CO2 emissions through transitions in industry and energy systems. Nat. Geosci. 11, 551–555 (2018).

Arce, G., López, L. A. & Guan, D. Carbon emissions embodied in international trade: the post-China era. Appl. Energy 184, 1063–1072 (2016).

Cohen, G., Jalles, J. T., Loungani, P. & Pizzuto, P. Trends and cycles in CO2 emissions and incomes: Cross-country evidence on decoupling. J. Macroecon. 71, 103397 (2022).

Zheng, B. et al. Trends in China’s anthropogenic emissions since 2010 as the consequence of clean air actions. Atmos. Chem. Phys. 18, 14095–14111 (2018).

Greenstone, M., He, G., Li, S. & Zou, E. Y. China’s war on pollution: evidence from the first 5 years. Rev. Environ. Econ. Policy 15, 281–299 (2021).

Ganguly, T., Selvaraj, K. L. & Guttikunda, S. K. National Clean Air Programme (NCAP) for Indian cities: review and outlook of clean air action plans. Atmos. Environ. 8, 100096 (2020).

Andreoni, J. & Levinson, A. The simple analytics of the environmental Kuznets curve. J. Public Econ. 80, 269 – 286 (2001).

Brock, W. A. & Taylor., M. S. The kindergarten rule of sustainable growth. National Bureau of Economic Research. WP #9597 (2003).

Brock, W. A. & Taylor, M. S. The green solow model. J. Econ. Growth 15, 127–153 (2010).

Carson, R. T. The environmental Kuznets curve: seeking empirical regularity and theoretical structure. Rev. Environ. Econ. Policy (2010).

Rickels, W., Meier, F. & Quaas, M. The historical social cost of fossil and industrial CO2 emissions. Nat. Clim. Change 13, 742–747 (2023).

Kochi, I., Hubbell, B. & Kramer, R. An empirical bayes approach to combining and comparing estimates of the value of a statistical life for environmental policy analysis. Environ. Resour. Econ. 34, 385–406 (2006).

Narain, U. & Sall, C. Methodology for Valuing the Health Impacts of Air Pollution: Discussion of Challenges and Proposed Solutions (World Bank, 2016).

Hammitt, J. K. & Robinson, L. A. The income elasticity of the value per statistical life: transferring estimates between high and low income populations. J. Benefit-Cost. Anal. 2, 1–29 (2011).

Crippa, M. et al. Fossil CO2 and GHG Emissions of All World Countries. (Luxemburg: Publication Office of the European Union, 2019).

IWG. Technical Support Document: Social Cost of Carbon, Methane, and Nitrous Oxide Interim Estimates under Executive Order 13990. United States Government (2021).

Environment and Climate Change Canada. Technical update to environment and climate change Canada’s social cost of greenhouse gas estimates. Government of Canada (2016).

German Environment Agency. Methodological Convention 3.0 for the Assessment of Environmental Costs (2019).

National Academies of Sciences, Engineering, and Medicine. Valuing climate damages: updating estimation of the social cost of carbon dioxide (National Academies Press, 2017).

Pizer, W. et al. Using and improving the social cost of carbon. Science 346, 1189–1190 (2014).

Bento, A. M. et al. Flawed analyses of us auto fuel economy standards. Science 362, 1119–1121 (2018).

Wagner, G. et al. Eight priorities for calculating the social cost of carbon. Nature 590, 548-550 https://doi.org/10.1038/d41586-021-00441-0 (2021).

Hammer, M. S. et al. Global estimates and long-term trends of fine particulate matter concentrations (1998-2018). Environ. Sci. Technol. 54, 7879–7890 (2020).

Van Donkelaar, A. et al. Global estimates of fine particulate matter using a combined geophysical-statistical method with information from satellites, models, and monitors. Environ. Sci. Technol. 50, 3762–3772 (2016).

Global Burden of Disease Collaborative Network. Global Burden of Disease Study 2019 (GBD 2019) Results (2019).

Cohen, A. J. et al. Estimates and 25-year trends of the global burden of disease attributable to ambient air pollution: an analysis of data from the global burden of diseases study 2015. Lancet 389, 1907–1918 (2017).

Burnett, R. et al. Global estimates of mortality associated with long-term exposure to outdoor fine particulate matter. Proc. Natl Acad. Sci. 115, 9592–9597 (2018).

World Bank. GDP (constant 2010 US$). https://data.worldbank.org/indicator/NY.GDP.MKTP.KD (2018).

Robinson, L. A. & Hammitt, J. K. The value of reducing air pollution risks in sub-Saharan Africa (2009).

Cropper, M. L. & Sahin, S. Valuing Mortality and Morbidity in the Context of Disaster Risks (The World Bank, 2009).

Masterman, C. J. & Viscusi, W. K. The income elasticity of global values of a statistical life: stated preference evidence. J. Benefit-Cost. Anal. 9, 407–434 (2018).

Rauner, S. et al. Coal-exit health and environmental damage reductions outweigh economic impacts. Nat. Clim. Change 10, 308–312 (2020).

Shindell, D. et al. Simultaneously mitigating near-term climate change and improving human health and food security. Science 335, 183–189 (2012).

Łyszczarz, B. Production losses associated with premature mortality in 28 European Union countries. J. Glob. Health 9 (2019).

Acknowledgements

A.M. acknowledges funding from the Department of Engineering and Public Policy at Carnegie Mellon University and the Andlinger Center for Energy and the Environment at Princeton University. R.V.M. acknowledges funding from NASA (Grant 80NSSC21K0508).

Author information

Authors and Affiliations

Contributions

A.M. and N.Z.M. conceptualized the study. A.M., N.Z.M., A.T., R.V.M., M.S.H., A.V.D. all contributed to data collection and analysis. A.M. and N.Z.M. wrote the paper and prepared the figures with inputs from A.T., R.V.M., M.S.H., and A.V.D.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Peer review

Peer review information

Communications Earth & Environment thanks the anonymous reviewers for their contribution to the peer review of this work. Primary Handling Editors: Martina Grecequet. A peer review file is available.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Mohan, A., Muller, N.Z., Thyagarajan, A. et al. Measuring global monetary damages from particulate matter and carbon dioxide emissions to track sustainable growth. Commun Earth Environ 5, 264 (2024). https://doi.org/10.1038/s43247-024-01426-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1038/s43247-024-01426-3

Comments

By submitting a comment you agree to abide by our Terms and Community Guidelines. If you find something abusive or that does not comply with our terms or guidelines please flag it as inappropriate.