Abstract

The link between the financial success of family companies during COVID-19 and their environmental, social, and governance (ESG) performance is examined for the first time in this research. We have a natural setting in the COVID-19 era to see if the market rewards family-run firms that integrate social and environmental concerns into their goals during uncertain times. Since they can enhance their image and reputation, which the market values, these companies are likely to pursue broader social objectives, such as environmental improvement (socioemotional wealth perspective); alternatively, managers can act as stewards of the family’s interests by using these initiatives to increase the company’s value (stewardship perspective). However, it is also possible that in this type of companies economic interests prevail over social wellness (“amoral familism”). Therefore, family-owned firms could be reluctant to implement ESG practices unless they yield certain socioemotional benefits, including enhancing or maintaining their reputation in the public eye. In light of the above, we use an international display of the 500 biggest family firms in the world from 2015 to 2021. Taking into account an endogenous relationship between ESG performance and family business value, the study uses generalized moments to construct a dynamic panel (GMM). The primary conclusion is that there is a positive correlation between corporate valuation and ESG performance. Nonetheless, it has been noted that the performance of the companies is negatively impacted during the COVID-19 period. However, for firms with superior ESG performance, this negative impact did not exist over this period, supporting the idea that investors view better ESG performance as a prediction of future good stock performance. The results have a variety of implications. To begin with, this study adds to the body of knowledge on the environmentally friendly and sustainable expansion of family companies by providing recommendations for investors and businesses to better understand the influence of ESG on the profitability of family businesses. Furthermore, managers have to concentrate on enhancing the ESG performance of their organizations as it has the potential to increase value, draw in investments, encourage sustainability, control risks, affect earnings, and interact with the ownership structure. Additionally, managers need to consider how important it is to have a strong ESG performance in order to mitigate the negative effects of external crises like the COVID-19 epidemic. It’s crucial to remember that the precise impact might change based on the sector and other aspects unique to each company.

Similar content being viewed by others

Introduction

The COVID-19 period has attracted the attention of researchers to investigate how companies make different corporate decisions to increase their value in times of uncertainty. In this context, ESG initiatives taken by companies can be interpreted by investors as a signal of the company’s future performance, which would lead them to prefer to invest in such companies during peak periods, thus increasing their value. Thus, in order to further study in this field, scholars have focused especially on examining the success of companies using ESG principles throughout this time (Broadstock et al., 2021). Contradictory conclusions have been drawn from the actual facts on the impact of ESG performance during the COVID-19 crisis thus far. On the one hand, a positive relationship between ESG performance and firm value has been reported (Habib and Mourad, 2023; Albuquerque et al., 2020; Garel and Petit-Romec, 2021; Engelhardt et al., 2021; Gregory, 2022; Broadstock et al., 2021); on the other hand, other studies have reported a negative relationship (Demers et al. 2021). Thus, the contribution of ESG initiatives to firm value creation remains an unresolved issue in academic research.

In this context, family firms provide a convenient “laboratory” to study the relationship between ESG performance and their financial performance, because, on the one hand, it is likely that these types of firms undertake ESG initiatives because, in line with the Socio-Emotional Wealth (SEW) perspective, this type of initiative would enhance the image and reputation of the firm, which would be valued by investors. In turn, the interests of the managers of these companies may be aligned with those of the family, thus acting as guardians of the family’s wealth and incorporating ESG initiatives to increase the value of these companies (stewardship perspective). On the other hand, the family’s economic interests may take precedence over social well-being (“amoral familism”), and ESG performance would not contribute to the value of this type of company. A small number of research indicate that family-owned firms adhere to environmental regulations and outperform non-family firms in this regard in order to preserve their socioemotional riches (Berrone et al., 2010). Family ownership is positively correlated with the inclination to participate in pollution prevention and control, according to Agostino and Ruberto (2021), while Graafland (2020) demonstrates the positive impact of family ownership on environmental performance. According to a recent study, there is a statistically substantial and positive correlation between business value and ESG performance (Espinosa et al., 2023). However, we do not know if in times of uncertainty, as it has been during the COVID-19 period, the results are maintained in family businesses. Given the above, this article compromises an international sample of the world’s 500 largest family firms over the period 2015–2021. Regarding the methodology, the study estimates a dynamic panel using the generalized methods of moments (GMM). The first finding is that ESG performance is positively associated with company value. Nonetheless, it has been noted that the performance of the companies is negatively impacted during the COVID-19 period. However, for firms with superior ESG performance, this negative impact did not exist over this period, confirming the idea that investors view better ESG performance as a sign of future higher stock success.

The remainder of the paper is organized as follows: Section 2 presents the literature review and the hypothses. Section 3 describes the sample and the methodology. Section 4 shows the empirical results and finally Section 5 presents the conclusions, limitations and implications of the study for future research.

Literature review

ESG performance and firm value

For years, scholars and business researchers have discussed how ESG performance influences company value (Adoğmuş et al. 2022), but they have not been able to definitively determine how it impacts how an organization operates. On the one hand, various empirical studies have shown a positive relationship between ESG performance and the firm’s value, supporting the idea that social responsible businesses can better serve stakeholders’ interests and create new possibilities for increasing growth and improve risk diversification (Fatemi and Fooladi, 2013). In this line, Wu et al. (2022) find that ESG performance is crucial for enhancing firm value for Chinese manufacturing listed enterprises and El Ghoul et al. (2017) discover that, out of a sample of 53 countries, ESG activities had a positive effect on business value, especially in nations with less established financial systems. Chen et al. (2023) found similar results for a sample of 3332 listed organizations globally spanning the years 2011–2020. However, other research indicates that investors may penalize the firm because they believe that ESG investments are expensive (Fatemi et al. 2018). In this sense, Kim and Lyon (2015) report that companies that disclose environmentally friendly business activities show negative abnormal returns and Zahid et al. (2022) report that ESG has a significantly negative effect on a firm’s financial performance.Footnote 1

In the debate about the impact of ESG performance on firm value, the COVID-19 period has provided a natural setting for researchers to examine whether such initiatives can enhance firm profits in times of uncertainty. In this context, the literature is inconclusive as to whether improved ESG performance during the COVID-19 period has a positive impact on firm financial performance. On the one hand, Albuquerque et al. (2020) report that stocks with high ESG ratings outperformed significantly higher than other stocks during the first quarter of 2020. Garel and Petit-Romec (2021) show that actions addressing climate change are mostly responsible for the superior stock returns experienced by companies with responsible environmental strategies. High ESG ratings are linked to higher excess returns in Europe, according to Engelhardt et al. (2021). Habib and Mourad (2023) discovered that, among a sample of 406 US enterprises that embraced ESG issues between 2016 and 2020, those with more advanced ESG practices had superior performance metrics. According to Gregory’s (2022) research, non-financial enterprises that scored well on environmental and governance standards fared better during the US pandemic. Broadstock et al. (2021) show that ESG performance is positively associated with the short-term cumulative returns of CSI300 stocks around the COVID-19 crisis. Almosh and Khatib (2023) indicate a positive relationship between financial performance and ESG performance throughout this period. Demers et al. (2021) reveal that ESG ratings did not positively influence returns during the COVID crisis in the first quarter of 2020, whereas Hoang et al. (2021) indicate that high ESG ratings are connected with reduced stock volatility but not greater returns in European enterprises during the pandemic.

ESG performance and value of family firms

Family businesses play a significant role in the global economy. According to Neckebrouck et al. (2018), they employ roughly 60% of the workforce worldwide and make up over 90% of all businesses (Aldrich and Cliff, 2003). In terms of revenue, the largest 500 family businesses generated USD 7.28 trillion in 2021, placing them third only after the economies of the United States and China.

It is uncertain from a theoretical standpoint if family businesses are more likely to adopt ESG practices than non-family businesses. Family businesses are more likely to commit to environmental protection in order to preserve their family’s affective endowment, according to the socioemotional wealth (SEW) framework. On the one hand, this suggests that family businesses are more eager to engage in social practices that benefit external stakeholders in order to gain greater reputational benefits (Cruz et al. 2014). In turn, stewardship theory suggests that family managers act as the company’s guardians, promoting long-term investments and broader societal objectives like environmental enhancement. Therefore, strengthening social binding ties can make them more inclined to contribute to wider societal interests through improving environmental and corporate social responsibility (Graafland, 2020). On the other hand, family-owned businesses may be reluctant to implement ESG policies if family economic interests take precedence over social wellbeing (a phenomenon known as “amoral familism,” Banfield, 1958). This is unless they stand to gain some sort of socioemotional welfare, such as the maintenance or enhancement of their public image. Moreover, a family-centric approach that places a higher priority on kindness may exacerbate internal family tensions, which might discourage businesses from making creative and risky investments like those needed to adopt environmental initiatives (Fan et al. 2021; Sharma and Sharma, 2011).

According to a number of studies, family firms are more resilient than nonfamily firms during periods of typical economic growth (Chrisman et al. 2010; Conz et al. 2020), However, except from a few single-country studies, the subject of whether a family firm’s greater capacity to overcome obstacles holds true when confronted with a global health crisis remains largely unexplored. According to Amore et al. (2022), family firms performed better in the market and were more profitable to operate throughout the pandemic. Carletti et al. (2020) find that distress is more frequent for small and medium-sized enterprises, for firms with high pre-COVID-19 leverage, and for firms belonging to the Manufacturing and Wholesale Trading sectors. Miroshnychenko et al. (2024) have shown that family-owned businesses’ financial performance during the COVID-19 pandemic was much greater than that of nonfamily businesses, and Espinosa-Méndez et al. (2023) have found a positive correlation between the two factors. However, we are unsure if this relationship will endure over longer periods of time like COVID-19.

Given the above discussion, it is unclear whether the family business would have more or less incentive to pursue ESG policies during COVID-19. First, ESG performance might be positively related to family firm value during COVID-19. Because the family is concerned about the welfare of all stakeholders, especially the financial wealth of the minority shareholders, investors may view ESG performance as a sign of future stock performance that will be positive, meaning that family businesses with higher ESG performance will also have higher firm values. Second, if family economic interests are at odds with societal welfare during COVID-19, then ESG performance may have a negative relationship with family company value. This may occur as a result of the family protecting its own SEW and looking out for themselves. Given the foregoing, we investigate the following alternative hypotheses:

Hypothesis 1a (H1a). ESG performance has a positive effect on the financial performance of the family firm during the COVID-19 period.

Hypothesis 1b (H1b). ESG performance has a negative effect on the financial performance of the family firm during the COVID-19 period.

Sample and methodology

Sample

We employ an international sample of the 500 largest family-owned firms worldwide over the period 2015–2021 based on the Ernest and Young (EY) and University of St. Gallen family Business index.Footnote 2We obtain financial and market information and the environment, social and governance disclosure scores (ESG) for each firm from Thompson Reuters - Refinitiv Eikon. We eliminate banking institutions because their accounting practices differ from those of businesses in other sectors. We do not consider private family firms, bacause we do not count with their maket capitalization which is needed to compute the proxy for Tobin’s Q. Finally, we eliminate those companies for which financial information does not exist or is inconsistent. The final sample consists of 274 family firms publicly traded and 1118 firm-year observations. A description of the sample is shown in Table 1. We can observe that USA (13%), Mexico (10%) and France (7%) contain the highest number of firm-year observations.

Methodology

To analyze the relationship between ESG performance and family firms’ performance during COVID-19, we propose the following Equation:

Market-to-book ratio (\({MtoB}\)) serves as the dependent variable, to measure company performance, which is a Tobin’s Q proxy. As Kim et al. (2018), we define \({MtoB}\) as the book value of total assets minus the book value of equity, plus the market value of equity, divided by the book value of total assets. \({MtoB}\) is a variable that measures firm value based on the market value, which is related to the present value of the future free cash flow of the firms. The explanatory variable is the ESG score (ESG). COVID is a dicotomical variable that takes the value of 1 for the years 2020 and 2021 (COVID-19 pandemic period), and 0 in any other case. We include a series of control variables that potentially influence firm value (Core et al. 2006; Bhagat and Bolton, 2019), such as company size (Size) measured using a logarithm of total sales; degree of indebtedness (Debt), measured by the ratio of total indebtedness over total assets; tangibility (Tang), measured by the ratio between total fixed asset over total assets; Dividends (Div) measured as dividends paid in cash on total assets minus cash and short-term investments; Ownership concentration (Own) measured as the percentage of ownership held by the largest shareholder; and Cash holdings measured as cash and short-term investments on total assets. In addition, following Pinheiro et al. (2023) and Mooneeapen et al. (2022) who claim that each country’s institutional features have an influence on the ESG performance, we include the variables of Law Rule of each country (Civil, Common, Scandinavian and German) and Corruption Perceptions Index to control for institutional aspects. We also include dummy variables for every country to control for country level not captured by the control variables of the model. For robustness of the results, we use ROA as a second dependent variable measured as net income over total assets. In addition, we use DESG as a dichotomical variable that takes the value of 1 if ESG is greater than zero and 0 in any other case.

Recent studies have revealed endogenous selection issues between corporate financial performance and sustainability performance (Soytas et al. 2019). In this context, the environmental, social and governance responsibility investment can be seen as a strategic decision through which the family business takes advantage of its specific attributes (FFSA) in the markets (e.g., reputational benefits) to increase its performance. In this way, the causal link between ESG performance and financial performance can occur in two directions, either its FFSA allows the company to increase its profitability and, with additional resources, increase investment in environmental, social and governance responsibility or that its FFSA allows the company to enter various ESG-intensive markets and, as a result, increase its profitability. Consequently, it is possible to conclude that there is an endogenous link between the investment made in environmental, social, and governance responsibilities and the improvement in the company’s performance. Given this relationship, we can expect ESG performance to be correlated with the error term of Eq. (1) and because of this, the estimated coefficients may present some bias derived from the presence of endogenous selection problems of the model.

Given the above, we have estimated Eq. (1) using the panel data methodology. This methodology allows us to control unobservable heterogeneity and endogeneity problems, providing estimators with higher efficiency than other estimation methods (Arellano, 2003). Specifically, we estimate a dynamic panel using the generalized methods of moments (GMM) developed by Arellano and Bond (1991), Arellano and Bover (1995) and Blundell and Bond (1998). The GMM estimator requires that the over-identifying restrictions (all chosen instruments) are valid and that there is no second-order serial correlation in residuals. The first condition is tested with the Hansen test, while the second can be verified with Arellano and Bond’s test statistics. Therefore, the GMM estimator will be consistent even if second-order autocorrelation (m2) must not be present in the model (Pervan et al. 2019).

Results

Table 2 reports the main descriptive statistics for the variables used in the study. The mean (standard deviation) value of MtoB is 1.26 (0.86), the minimum and maximum values are 0.07 and 4.99, respectively. Turning to the explanatory variables, the mean (standard deviation) value of the overall ESG score (ESG) is 50.15 (21.51). These results, and those reported for the control variables, would indicate a high heterogeneity among family firms at an international level.

In relation to the control variables, the mean (standard deviation) values of Size, Debt, Tang, Div, Own and Cash: 16.04 (0.99), 0.29 (0.16), 0.62 (0.19), 2.70 (3.39), 0.35 (0.22) and 11.25 (8.90) respectively. Additionally, the results exhibited in Table 2 show a high dispersion in the value of these control variables.

Table 3 shows the correlation matrix. A positive and statistically significant correlation can be observed between MtoB and ESG score. Similarly, MtoB is positively and significantly related is negatively and significantly correlated with Div and Cash. So far, our results suggest that the ESG performance of family firms is positively associated with MtoB.

Table 4 reports the results of the estimations of Eq. (1) using the market-to-book ratio as a measure of the firm’s performance. Column 1 reports a positive and statistically significant association between ESG overall score and family firm’s performance (ESG = 0.194) when we do not include control variables. When we include the control variables, column 2, we also find a positive and statistically significant relationship between ESG overall score and family firm’s performance (ESG = 0.313). This result supports the idea that ESG performance is considered by the family firms as a mechanism to improve the firm value for all shareholders (Espinosa-Méndez et al. 2023). The results of this study provide credence to the hypothesis 1a (H1a) prediction, indicating a positive correlation between ESG disclosure ratings and family firm value.

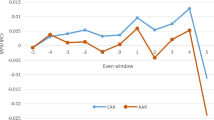

Column 3 reports separately on the impact of COVID-19 and ESG score on the performance of the family business. The ESG score remains stable at ESG = 0.234, while COVID-19 revealed a decline in the family business’s financial performance at COVID = −0.110. Both results are statistically significant. The total effect is shown in column 4, which indicates a positive correlation between the family firm’s performance throughout the COVID period and the ESG overall score (ESG*COVID = 0.969). That is, the negative effect of COVID on the performance of family businesses is cushioned when they perform better ESG. A dummy variable for ESG is used in Columns 5; it takes on the value of 1 when the ESG score is higher than the median and 0 otherwise. This variable is known as ESG High. The results show a positive and statistically significant relationship between ESG score and family firm performance (ESG High = 0.336). Thus, the higher the company’s ESG performance, the higher the family firm’s financial performance. Finally, in column 6, we examine whether this result holds during the COVID-19 period. We use the variable ESG High*COVID and find a positive, statistically significant and larger effect on the financial performance of the family business (ESG High = 0.542). The results show that ESG performance may be positively related to family firm value during COVID-19. Thus, investors may interpret ESG performance as a signal of positive future stock performance, and then family firms with higher ESG performance have higher firm value, which is consistent with the Socio-Emotional Wealth (SEW) perspective, which suggests that these types of initiatives would enhance the image and reputation of the firm, which would be valued by investors. In turn, this is consistent with the stewardship perspective, where the interests of the managers of these companies are aligned with those of the family, thus acting as guardians of the family’s wealth and incorporating ESG initiatives to increase the value of these companies.

As robustness of the results, we estimate all models using ROA as a dependent variable. The results are reported in Table 5. The results remain unchanged.In addition, we re-estimated the models (except models 5 and 6 which are similar to those in Table 3) using a dichotomical variable that takes the value of 1 if ESG is greater than zero and 0 in any other case (DESG). The results are reported in Table 6. The results remain unchanged.

Conclusions

In this article we investigate the relationship between environmental, social, and governance (ESG) performance and the financial performance of family businesses during COVID-19 since this period offers us a natural scenario to observe whether the market values family firms that consider environmental and social aspects in their objectives in times of uncertainty.

We concentrate on family businesses because it’s probable that they want to achieve more general societal goals, such environmental enhancement, which may help them build a better reputation and image, gain market value, and increase in value (socioemotional wealth perspective). By using these efforts to raise the company’s worth, managers might also take on the role of guardians of the family’s interests (stewardship perspective). However, it’s also likely that in this kind of business, financial gain takes precedence above social welfare (“amoral familism”). As a result, the family firm makes a useful “laboratory” for researching the connection between financial and ESG performance. We find that family firms with higher ESG performance have favorable and statistically significant financial success, which helps to mitigate the negative impact of COVID for an international sample of the 500 largest family firms worldwide over the period of 2015–2021. This is consistent with the idea that investors might use ESG performance as a predictor of future stock performance or as a mean to reduce risk during times of crisis (Broadstock et al., 2021).

Our article’s findings make many contributions to the financial literature. First off, to the best of our knowledge, this is the first piece of writing that looks into the connection between family companies’ financial results during COVID-19 and their ESG performance. Second, this study contributes to the body of information previously available on ESG performance and business value by giving new data based on a global sample of notable family firms. Thirdly, this research contributes to the body of knowledge on the green and sustainable growth of family firms, which is consistent with the extended SEW approach and does not conflict with maximizing shareholder wealth. The study makes recommendations for investors and businesses to help them understand the impact of ESG on family firms’ performance. In adittion, managers should focus on improving their companies’ ESG performance as it can enhance value, attract investments, promote sustainability, manage risks, influence earnings, and interact with the ownership structure.

Our article has some limitations. Firstly, the current study was limited to a sample of family firms. Future research can expand the sample or investigate the impact of ESG for samples that include non-family firms and/or firms belonging to economic groups. Second, the stakeholder theory was used in this study as a theoretical framework for interpreting the findings. In the future, scientists can investigate other explanations for occurrences, such the agency theory. Family firms are less efficient than nonfamily firms due to unique agency costs (Cucculelli et al., 2014). This consideration may lead to companies with greater agency problems where ESG initiatives have no impact on performance due to the potential diversion of resources, which could be viewed by investors as detrimental to the company and negatively impact its value. Thirdly, the study data were collected through Thomson Reuter’s database. Therefore, in order to determine how comparable the results are and any potential differences, we ask academics to look into similar studies utilizing various databases, such as Bloomberg. Additionally, the time frame might be extended to work on upcoming research projects. In adittion, approaches like restricted SEW and extended SEW may offer additional dimensions to look at the relationship between ESG performance and business value in terms of the heterogeneity of family firms. Finally, we encourage researchers to look into nonlinear relationships between ESG performance and family business performance as they may help to reconcile earlier findings on the relationship between these variables. This is in line with the studies of López-Penabad et al. (2022), who found a U-shaped relationship between corporate social performance and efficiency for a sample of 108 European listed banks across 21 countries over the period of 2011–2019.

Data availability

The data that support the findings of this study are available in a Stata file except for the ESG data which is proprietary to Refinitiv.

Notes

References

Adoğmuş M, Gülay G, Ergun K (2022) Impact of ESG performance on firm value and profitability. Borsa Istanbul Rev. https://doi.org/10.1016/j.bir.2022.11.006

Albuquerque R, Koskinen Y, Yang S, Zhang C (2020) Resiliency of environmental and social stocks: an analysis of the exogenous COVID-19 market crash. Rev Corp Financ Stud 9(3):59321. https://doi.org/10.1093/rcfs/cfaa011

Aldrich HE, Cliff JE (2003) The pervasive effects of family on entrepreneurship: toward a family embeddedness perspective. J Bus Ventur 18(5):573–596

Agostino M, Ruberto S (2021) Environment-friendly practices: family versus non-family firms. J Clean Prod 329:129689

Almosh H, Khatib S (2023) ESG performance in the time of COVID-19 pandemic: cross-country evidence. Environ Sci Pollut Res Int 30(14):39978–39993

Amore MD, Pelucco V, Quarato F (2022) Family ownership during the Covid-19 pandemic. J Bank Financ 135:106385

Arellano M (2003) Panel data econometrics. Econ J. https://doi.org/10.1093/0199245282.001.0001

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error components models. JEcon 68(1):29–51

Banfield EC (1958) The moral basis of a backward society. Free Press, Glencoe, II

Berrone P, Cruz C, Gomez-Mejia L, Larraza-Kintana M (2010) Socioemotional wealth and corporate responses to institutional pressures: do family-controlled firms pollute less? Adm Sci Q 55(1):82–113

Bhagat S, Bolton B (2019) Corporate governance and firm performance: the sequel. J Corp Financ 58:142–168

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econ 87(1):115–143

Broadstock D, Chan K, Cheng L, Wang X (2021) The role of ESG performance during times of financial crisis: evidence from COVID-19 in China. Financ Res Lett 38:101716

Carletti E, Oliviero T, Pagano M, Pelizzon L, Subrahmanyam M (2020) The covid-19 shock and equity shortfall: firm-level evidence from Italy. Rev Corpor Financ Stud 9:534–568

Chen S, Song Y, Gao P (2023) Environmental, social, and governance (ESG) performance and financial outcomes: analyzing the impact of ESG on financial performance. J Environ Manag 345:118829

Chrisman JJ, Chua JH, Pearson AW, Barnett T (2010) Family involvement, family influence, and family–centered non–economic goals in small firms. Entrep Theory Pr 36(2):267–293. https://doi.org/10.1111/j.1540-6520.2010.00407.x

Conz E, Lamb PW, De Massis A (2020) Practicing resilience in family firms: an investigation through phenomenography. J Fam Bus Strategy 11:100355

Core JE, Guay WR, Rusticus TO (2006) Does weak governance cause weak stock returns? an examination of firm operating performance and investors’ expectations. J Financ 61(2):655–687

Cruz C, Larraza–Kintana M, Garces-Galdeano L, Berrone P (2014) Are family firms really more socially responsible? Entrep Theory Pract. 38(6):1295–1316

Cucculelli M, Mannarino L, Pupo V, Ricotta F (2014) Owner-management, firm age, and productivity in italian family firms. J Small Bus Manag 52:325–343

Demers E, Hendrikse J, Joos P, Lev B (2021) ESG did not immunize stocks during the COVID-19 crisis, but investments in intangible assets did. J Bus Financ Account 48(3-4):433–462

El Ghoul S, Guedhami O, Kim Y (2017) Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J Int Bus Stud 48:360–385

Engelhardt N, Ekkenga J, Posch P (2021) ESG ratings and stock performance during the COVID-19 crisis. Sustainability 13(13):7133

Espinosa-Méndez C, Maquieira C, Arias J (2023) The impact of ESG performance on the value of family firms: the moderating role of financial constraints and agency problems. Sustainability 15(6176):2–20

Fan Y, Zhang F, Zhu L (2021) Do family firms invest more in pollution prevention strategy than non-family firms? an integration of agency and institutional theories. J Clean Prod 286:124988

Fatemi AM, Fooladi IJ (2013) Sustainable finance: a new paradigm. Glob Financ J 24:101–113

Fatemi A, Glaum M, Kaiser S (2018) ESG performance and firm value: the moderating role of disclosure. Glob Financ J 38:45–64

Garel A, Petit-Romec A (2021) Investor rewards to environmental responsibility: evidence from the COVID-19 crisis. J Corp Financ 68:101948

Graafland J (2020) Family business ownership and cleaner production: moderation by company size and family management. J Clean Prod 255:120120

Gregory TP (2022) ESG scores and the response of the S&P 1500 to monetary and fiscal policy during the Covid-19 pandemic. Int Rev Econ Financ 78:446–456

Habib A, Mourad N (2023). The Influence of environmental, social, and governance(ESG) practices on US firms’ -performance: evidencefrom the coronavirus crisis. J Knowl Econ https://doi.org/10.1007/s13132-023-01278-w

Hoang T, Segbotangni E, Amine L (2021) ESG performance and COVID-19 pandemic: an empirical analysis of European listed firms. https://ssrn.com/abstract=3855360

Horváthová E (2010) Does environmental performance affect financial performance? meta-analysis. Ecol Econ 70(1):52–59

Kim EH, Lyon TP (2015) Greenwash vs. brownwash: exaggeration and undue modesty in corporate sustainability disclosure. Organ Sci 26:705–723

Kim WS, Park K, Lee SH (2018) Corporate social responsibility, ownership structure, and firm value: evidence from Korea. Sustainability 10:2497

López-Penabad MC, Iglesias-Casal A, Silva JF, Maside-Sanfiz JM (2022) Does corporate social performance improve bank efficiency? evidence from European banks. Rev Manag Science 17:1399–1437

Miroshnychenko I, Vocalelli G, De Massis A, Grassi S, Ravazzolo F (2024) The COVID-19 pandemic and family business performance. Small Bus Econ 62:213–241

Mooneeapen O, Abhayawansa S, Mamode Khan N (2022) The influence of the country governance environment on corporate environmental, social and governance (ESG) performance. Sustainability Account Manag Policy J 13(4):953–985

Neckebrouck J, Schulze WS, Zellweger T (2018) Are family firms good employers? Acad Manag J 61(2):553–585

Pervan M, Pervan I, Ćurak M (2019) Determinants of firm profitability in the croatian manufacturing industry: evidence from dynamic panel analysis. Econ Res. Ekonomska Istraživanja 32(1):968–981

Pinheiro AB, dos Santos, JIAS, Cherobim, APMS, Segatto, AP (2023) What drives environmental, social and governance (ESG) performance? the role of institutional quality. J Environ Qual. https://doi.org/10.1108/MEQ-03-2023-0091

Renneboog L, Horst JT, Zhang C (2008) Socially responsible investments: institutional aspects, performance, and investor behaviour. J Bank Financ 32:1723–1742

Renneboog L, Horst JT, Zhang C (2008) The price of ethics and stakeholder governance: the performance of socially responsible mutual funds. J Corp Financ 14:302–322

Sharma P, Sharma S (2011) Drivers of proactive environmental strategy in family firms. Bus Ethics Q 21(2):309–334

Soytas MA, Denizel M, Durak Usar D (2019) Addressing endogeneity in the causal relationship between sustainability and financial performance. Int J Prod Econ 210:56–71

Wu S, Li X, Du X, Li Z (2022) The impact of ESG performance on firm value: the moderating role of ownership structure. Sustainability 14:14507

Zahid RMA, Taran A, Khan MK, Chersan, I (2022) The role of audit quality in the ESG-corporate financial performance nexus: empirical evidence from Western European companies. Borsa Istanbul Rev. https://doi.org/10.1016/j.bir.2022.08.011

Acknowledgements

This work was supported by the Proyecto Código 032061EM, Dirección de Investigación, Científica y Tecnológica, Dicyt. Universidad de Santiago de Chile, USACH. [032061EM].

Author information

Authors and Affiliations

Contributions

Conceptualization: CE, CM, JA; Methodology: CE, CM, JA; Software: CE, JA; Investigation: CE, CM, JA; Supervision: CE, CM; Writing- original draft: CE, CM, JA; Writing- review and editing: CE, CM, JA.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

Ethical approval was not required as the study did not involve human participants.

Informed consent

Informed consent was not required because the study did not involve human participants.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Espinosa-Méndez, C., Maquieira, C. & Arias, J.T. ESG performance on the value of family firms: international evidence during Covid-19. Humanit Soc Sci Commun 11, 586 (2024). https://doi.org/10.1057/s41599-024-03074-6

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-024-03074-6